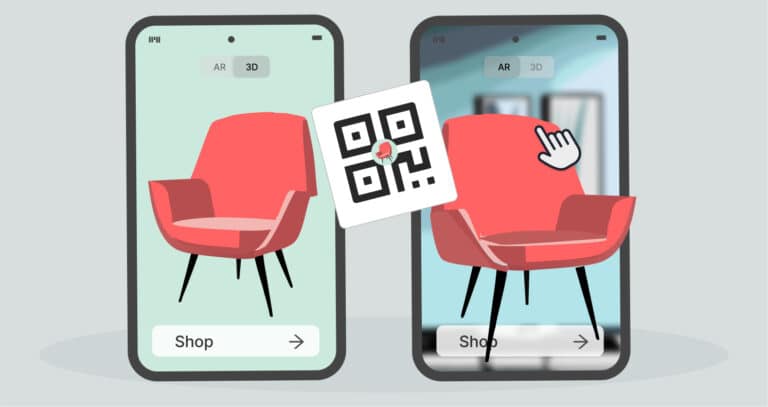

QR codes for Salone del Mobile: A designers’ and brands’ guide to connecting through 3D experiences

Introduction As one of the most anticipated events of year’s event and in the design world, Salone del Mobile in Milan represents an unparalleled opportunity